How many countries are in custody. See what "OPEC" is in other dictionaries. Analysis of export performance of developing countries

Securities have several types, one of them is corporate bonds. These are profitable investment instruments with a significant amount of risk. Nevertheless, the potential profitability and some features give rise to a stable demand for them. Let's take a closer look at why many investors invest in bonds, which are often guaranteed only by the image of the issuer.

What are corporate bonds

Corporate bonds are debt securities issued by commercial organizations.. They combine increased investment risk and medium or high returns. The issue is carried out by various companies: banks, manufacturing enterprises, trading firms.

The purpose of issuing bonds to the stock market is:

- Increasing the company's working capital.

- Financing of large projects (modernization, construction, purchase of equipment, expansion of the range, etc.).

Sometimes the issuance of securities turns out to be more profitable for companies than taking out a loan. The total amount of the overpayment is lower, and with a proper image and a good credit rating, the demand for bonds will grow.

Important! They issue corporate bonds of all types: discount and coupon, convertible or amortization. An extensive choice of issuers and options will allow you to purchase exactly those securities that are necessary to meet the needs of investors.

Types of securities

Corporate bonds are divided into different types:

- Secured. The guarantee is the provision of assets in the form of real estate, land, materials, etc. If the issuing company goes bankrupt, the property is sold and the funds received are paid to investors.

- Unsecured. When buying such bonds, one should take into account the reputation of the issuer, profitability and economic activity. If the company goes bankrupt, it will not be able to pay off the holders.

According to the form of profit calculation:

- Interest or . The stock market offers investors all types of coupon payments: fixed, floating, variable.

- Interest-free or discounted. The sale price of such securities is below par.

By period and form of existence:

- Urgent. The maturity date is set: short-term - up to 12 months, medium-term - from 12 months to 5 years, long-term - more than 5 years.

- Perpetual. Although they are called “perpetual,” there is still a maturity period, but it is not set at the time the bond is issued. The initiator of redemption can be either the investor or the issuer itself.

By subject of rights:

- Registered (only the registered owner can use such a bond).

- To the bearer (the owner is not registered, he retains the right to sell, donate or transfer the security by inheritance).

Also, bonds are divided by the method of redemption. These may be ordinary securities, the par value of which is paid at the end of the circulation period. Or depreciation, in this case, the face value is returned in parts during the possession of the security.

There are also convertible bonds on the market. The owner has the right to exchange them for shares in the issuing company or another organization. The number of shares and their price are set in advance, and the exchange is made at the request of the holder. There is another conversion option - the exchange of existing bonds for others.

Risks of corporate bonds

World practice shows that the risks of corporate bonds are much higher than government or. The interest rate and the final yield on them are almost always higher. This also applies to securities of large and well-known companies with impeccable creditworthiness.

The main risks include:

- Default risk. The influence is exerted by the position of the market economy, the rating of the institution and other factors.

- Credit spread risk. With a significant deterioration in the company's position in the market, the spread becomes insufficient.

- Liquidity risk. If the situation on the market changes not in favor of the company that issued the securities, then the market price will fall.

- The risk of inflation. In all cases, inflation leads to a decrease in the market value of the company's bonds, even its expectation contributes to a decrease in the price of the security. But in some cases, inflation can have the opposite effect.

- Interest rate risk. If the coupon rate is tied to variable rates, then there is a possibility of their strong fall. Against the backdrop of such changes, the market value will also decrease.

If we look at the example: Household money-1-bob, the rate is up to 20% per annum. At first glance, this is a very profitable investment, but if you look at all the nuances, the high risk is also obvious.

In 2017, the bonds defaulted, and the company is quite large and had a positive reputation until that moment. Commitments on issues with a similar amount of cash were fulfilled. As the summary shows, the fact of the default was quite recent, which means that there is a possibility of a repeat. Before choosing, you should study in detail financial condition issuer.

In addition, you need to consider the terms of release.

The denomination is quite high and many times exceeds the usual 1,000 rubles. Thus, increased profitability is associated with risk and large initial investments. Moreover, ACI is not taken into account here, with a nominal value of 2,000,000 rubles, it will significantly increase the sale price.

Highly reliable AHML bonds with a face value of 1,000 rubles bring a very modest coupon yield of 3% per annum for the entire period of circulation.

But there is little doubt about the reliability of the company, it is organized with the support of the state.

Corporate bond market in Russia

The Russian corporate securities market for 2018 is considered to be quite developed. Investors can choose from a wide range of companies issuing corporate bonds of all types and sizes.

Often, issuing companies are guided by the terms of GKO (one of the types of government bonds). But this does not mean that the rates are the same. Commercial or industrial organizations form very flexible conditions.

The Moscow Exchange is rich in offers of corporate bonds for the purchase of securities from both large institutions (Sberbank, Lukoil, etc.) and small ones. All corporations are classified into three echelons:

- Echelon 1 - highly liquid companies, the spread of which is minimal in relation to the purchase price to the sale price (, Sberbank, VTB, Lukoil, Transneft, Rostelecom, MTS, Megafon).

- Echelon 2 - representative institutions of regional and industry leading companies. However, their quality is an order of magnitude lower than that of first-tier companies, so investors in cooperation with them receive more risk.

- Echelon 3 - companies with ambiguous plans for the future and a low credit rating. These include small firms that set a high growth rate in the market. At the same time, investors receive a relatively high risk that such companies will default on their debt obligations. The spread on bonds usually does not exceed a few percent of the face value due to rare transactions and low turnover.

General analysis shows:

These are the maximum indicators of various bonds, the conditions of many may differ significantly. In the tables you can see an overview of the basic data on securities in circulation.

Bonds of Russian banks:

| Release | Coupon | Duration, days | Net price, % | ||

|---|---|---|---|---|---|

| % | type of | ||||

| Absolut Bank-5-bob | 7,95 | Change. | 10,9493 | 237 | 97,952 |

| Vanguard AKB-BO-001P-01 | 7,25 | Change. | 9,372 | 179 | 98,812 |

| Alfa-Bank-5-bob | 8,15 | Change. | 7,5139 | 53 | 100,06 |

| Bank VTB-B-1-5 | 0,01 | Constant | 10,0309 | 262 | 93,29 |

| Sberbank-001-03R | 8,0 | Constant | 7,6718 | 755 | 100,19 |

| RSHB-13-ob | 7,8 | Change. | 7,7251 | 304 | 99,99 |

| deltacredit-26-bob | 10,3 | Change. | 7,5565 | 318 | 102,234 |

| Promsvyazbank-BO-PO1 | 10,15 | Change. | 7,7524 | 845 | 104,66 |

Bonds of various companies and enterprises:

| Release | Coupon | Simple yield to maturity, % | Duration, days | Net price, % | |

|---|---|---|---|---|---|

| % | type of | ||||

| Avtodor-001Р-01 | 10,25 | Constant | 8,2195 | 732 | 103,417 |

| Ashinsky metallurgical plant-1-bob | 8,75 | floating | 74,8277 | 118 | 82,5 |

| Bashneft-3-bob | 12,0 | Change. | 11,2138 | 567 | 100,59 |

| Russian Helicopters-1-bob | 11,9 | Constant | 8,0873 | 1919 | 117,232 |

| Gazprom-22-bob | 8,1 | Change. | 8,6241 | 1959 | 97,5 |

| Russian Post-2-bob | 10,0 | Change. | 7,009 | 252 | 101,902 |

| RZD-17-bob | 9,85 | Change. | 6,8183 | 2849 | 119,448 |

| Aircraft GK-BO-PO2 | 11,5 | Constant | 11,4062 | 1220 | 100,001 |

Advantages and disadvantages

The key advantage of corporate bonds is a wide choice, largely covering demand. There are options for a conservative investment model, risky or optimal, where the amount of income is comparable to the risk.

The issue of securities on the market is carried out by both large and very reliable companies, such as Gazprombank, Sberbank, and small, little-known organizations.

The pros and cons of securities can be combined into one list:

- The return is proportional to the risk. The most reliable bonds are less volatile and cannot act as a speculative instrument. High-yields are more prone to default.

- There are bonds of all kinds on the market, which is convenient, but the choice becomes more complicated.

- Any investor, even a beginner, can buy bonds. But first, it is necessary to conduct a profitability analysis, an assessment of default. Transparency of data on assets allows you to get all the necessary information, but buying without prior study can carry a high risk and result in a loss of investment. In the case of OFZs and municipal bonds, the situation is much simpler.

- Corporate bonds are traded on both the primary and secondary markets. This makes it possible to buy and sell them at any time, extracting maximum profit through speculation. Market prices can fluctuate significantly, increasing financial benefits, but for competent management, an investor needs a basic knowledge of the basics stock market and in particular the bond market.

Corporate bonds must be part of the investor's portfolio. The reliability of many companies can exceed the reliability of some banks, which reduces risk while maintaining an acceptable return. And risky trades can quickly increase capital. These are securities with flexible terms, a wide choice of issuers and parameters.

In September last year, the OPEC organization celebrated its anniversary. It was established in 1960. Today, OPEC countries occupy a leading position in the field of economic development.

OPEC in translation from English "OPEC" - "Organization of Petroleum Exporting Countries". it international organization, created to control the volume of sales of crude oil and setting the price for it.

By the time OPEC was created, there were significant surpluses of black gold in the oil market. The appearance of an excess amount of oil is explained by the rapid development of its vast deposits. The main supplier of oil was the Middle East. In the mid-1950s, the USSR entered the oil market. The production of black gold in our country has doubled.This has resulted in the emergence of serious competition in the market. Against this backdrop, oil prices fell significantly. This contributed to the creation of the OPEC organization. 55 years ago, this organization pursued the goal of maintaining an adequate level of oil prices.

Which states are included

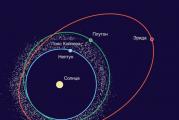

To date, this organization includes 12 powers. These include the states of the Middle East, Africa and Asia.

Russia is not a member of OPEC in 2019. The characterization of the powers that are part of this organization is not an easy task. Only one thing can be said with certainty: just like 55 years ago, today the countries on the list are united by oil politics.

The initiator of the creation of this organization was. Initially, it was included in the list, as well as the leading oil exporting states. After that, the list was replenished and. Libya entered the list not during the time of Colonel Gaddafi, as many people think, but under King Idris, in 1962. entered the list only in 1967.

In the period 1969-1973. the list was replenished with such members as , and . In 1975, Gabon added to the list. In 2007, she entered the list. Whether the OPEC list will be replenished in the near future is not known for certain.

What are the countries

The states that are part of this organization in 2019 produce only 44% of the world's oil production. But these countries have a huge impact on the black gold market. This is explained by the fact that the states that are part of this organization own 77% of all proven oil reserves in the world.

At the heart of the economy Saudi Arabia is the export of oil. Today, this black gold exporting state has 25% of oil reserves. Thanks to the export of black gold, the country receives 90% of its income. The GDP of this largest exporting state is 45 percent.

The second place in gold mining is given. Today, this state, which is a major oil exporter, occupies 5.5% of the world market. No less large exporter should be considered. The extraction of black gold brings the country 90% of the profit.

Until 2011, Libya occupied an enviable place in oil production. Today the situation in this, there is no time richest state, can be called not just complex, but critical.

The third largest oil reserves are. The southern deposits of this country can produce up to 1.8 million black gold in one day alone.

It can be concluded that most of the OPEC member states are dependent on the profits that their oil industry brings. The only exception to these 12 states is Indonesia. This country also receives income from such industries as:

For other powers that are part of OPEC, the percentage of dependence on the sale of black gold can range from 48 to 97 indicators.

When difficult times come, the states with rich oil reserves have only one way out - to diversify the economy as soon as possible. This happens due to the development of new technologies that contribute to the conservation of resources.

Organization policy

In addition to the goal of unifying and coordinating oil policy, the organization has a no less priority task - to consider the stimulation of economical and regular deliveries of goods by members of those states that are consumers. Another important goal is to obtain a fair return on capital. This is true for those who actively invest in the industry.

The main governing bodies of OPEC include:

- Conference.

- Advice.

- Secretariat.

The conference is supreme body this organization. The highest position should be considered the position Secretary General.

Meetings of energy ministers and black gold specialists take place twice a year. The main purpose of the meeting is to assess the state of the international oil market. Another priority task is to develop a clear plan to stabilize the situation. The third purpose of the meeting is to predict the situation.

The forecast of the organization can be judged by the situation on the black gold market last year. Representatives of the member countries of this organization argued that prices would be kept at the rate of 40-50 US dollars per 1 barrel. At the same time, representatives of these states did not rule out that prices could rise up to $60. This could happen only in the event of an intensive growth of the Chinese economy.

Judging by latest information, in the plans of the leadership of this organization there is no desire to reduce the amount of oil products produced. Also, the OPEC organization has no plans to interfere in the activities of international markets. According to the management of the organization, it is necessary to give the international market a chance for independent regulation.

Today, oil prices are close to the critical point. But the situation on the market is such that prices can both rapidly fall and rise.

Attempts to resolve the situation

After the start of the next economic crisis, which swept the whole world, the OPEC countries decided to meet again. Prior to this, 12 states were meeting when there was a record drop in black gold futures. Then the size of the fall was catastrophic - up to 25 percent.

Judging by the forecast given by the experts of the organization, the crisis will not affect only Qatar. In 2018, the price of Brent crude was about $60 per barrel.

Price policy

Today, the situation for the OPEC members themselves is as follows:

- Iran is the price by which a deficit-free budget of the state is provided - 87 US dollars (the share in the organization is 8.4%).

- Iraq - $81 (share in the organization - 13%).

- Kuwait - $67 (share in the organization - 8.7%).

- Saudi Arabia - $106 (share in the organization - 32%).

- UAE - $73 (share in the organization - 9.2%).

- Venezuela - $125 (share in the organization - 7.8%).

According to some reports, at an informal meeting, Venezuela made a proposal to reduce the current volume of oil production to 5 percent. This information has not yet been confirmed.

The situation within the organization itself can be called critical. The year of black gold that has fallen in price has hit hard on the pockets of the OPEC states. According to some reports, the total income of the participating states may drop to 550 billion US dollars a year. The previous five-year plan showed much higher rates. Then the annual income of these countries is 1 trillion. USD.

The Organization of the Petroleum Exporting Countries, founded in 1960 by a number of countries (Algeria, Ecuador, Indonesia, Iraq, Iran, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates and Venezuela) to coordinate sales and pricing of crude oil.

Due to the fact that OPEC controls about half of the world's oil trade, it is able to significantly influence the level of world prices. The share of the oil cartel, which in 1962 was registered with the UN as a full-fledged intergovernmental organization, accounts for about 40% of world oil production.

Brief economic characteristics of the OPEC member states (in 2005)

| Algeria | Indonesia | Iran | Iraq | Kuwait | Libya | Nigeria | Qatar | Saudi Arabia | UAE | Venezuela | |

| Population (thousand people) | 32,906 | 217,99 | 68,6 | 28,832 | 2,76 | 5,853 | 131,759 | 824 | 23,956 | 4,5 | 26,756 |

| Area (thousand km 2) | 2,382 | 1,904 | 1,648 | 438 | 18 | 1,76 | 924 | 11 | 2,15 | 84 | 916 |

| Population density (persons per km 2) | 14 | 114 | 42 | 66 | 153 | 3 | 143 | 75 | 11 | 54 | 29 |

| GDP per capita ($) | 3,113 | 1,29 | 2,863 | 1,063 | 27,028 | 6,618 | 752 | 45,937 | 12,931 | 29,367 | 5,24 |

| GDP at market prices (million $) | 102,439 | 281,16 | 196,409 | 30,647 | 74,598 | 38,735 | 99,147 | 37,852 | 309,772 | 132,15 | 140,192 |

| Export volume (mln $) | 45,631 | 86,179 | 60,012 | 24,027 | 45,011 | 28,7 | 47,928 | 24,386 | 174,635 | 111,116 | 55,487 |

| Oil export volume (mln $) | 32,882 | 9,248 | 48,286 | 23,4 | 42,583 | 28,324 | 46,77 | 18,634 | 164,71 | 49,7 | 48,059 |

| Current balance (mln $) | 17,615 | 2,996 | 13,268 | -6,505 | 32,627 | 10,726 | 25,573 | 7,063 | 87,132 | 18,54 | 25,359 |

| Proved oil reserves (million barrels) | 12,27 | 4,301 | 136,27 | 115 | 101,5 | 41,464 | 36,22 | 15,207 | 264,211 | 97,8 | 80,012 |

| Proven reserves natural gas(billion cubic meters) | 4,58 | 2,769 | 27,58 | 3,17 | 1,557 | 1,491 | 5,152 | 25,783 | 6,9 | 6,06 | 4,315 |

| Crude oil production (1,000 bbl/d) | 1,352 | 1,059 | 4,092 | 1,913 | 2,573 | 1,693 | 2,366 | 766 | 9,353 | 2,378 | 3,128 |

| Natural gas production volume (million cubic meters/day) | 89,235 | 76 | 94,55 | 2,65 | 12,2 | 11,7 | 21,8 | 43,5 | 71,24 | 46,6 | 28,9 |

| Oil processing capacity (1,000 bbl/day) | 462 | 1,057 | 1,474 | 603 | 936 | 380 | 445 | 80 | 2,091 | 466 | 1,054 |

| Production of petroleum products (1,000 bbl/day) | 452 | 1,054 | 1,44 | 477 | 911 | 460 | 388 | 119 | 1,974 | 442 | 1,198 |

| Consumption of petroleum products (1,000 bbl/day) | 246 | 1,14 | 1,512 | 514 | 249 | 243 | 253 | 60 | 1,227 | 204 | 506 |

| Crude oil export volume (1,000 bbl/day) | 970 | 374 | 2,395 | 1,472 | 1,65 | 1,306 | 2,326 | 677 | 7,209 | 2,195 | 2,198 |

| Export volume of petroleum products (1,000 bbl/day) | 464 | 142 | 402 | 14 | 614 | 163 | 49 | 77 | 1,385 | 509 | 609 |

| Natural gas export volume (million cubic meters) | 64,266 | 36,6 | 4,735 | -- | -- | 5,4 | 12 | 27,6 | --7,499 | -- |

Main objectives of OPEC

The main objectives of the creation of the Organization are:

- Coordination and unification of the oil policy of the Member States.

- Determination of the most effective individual and collective means of protecting their interests.

- Ensuring price stability on world oil markets.

- Attention to the interests of oil-producing countries and the need to ensure: sustainable income of oil-producing countries; efficient, cost-effective and regular supply of consumer countries; fair returns on investments in the oil industry; protection environment for the benefit of present and future generations.

- cooperation with non-OPEC countries in order to implement initiatives to stabilize the world oil market.

Only founding members and those countries whose applications for admission have been approved by the conference can be full members. Any other country that exports significant amounts of crude oil and has interests fundamentally similar to those of member countries can become a full member, provided that its admission is approved by a 3/4 majority vote, including the votes of all founding members.

Organizational structure of OPEC

The supreme body of OPEC is the Conference of Ministers of the member states, there is also a Board of Directors, in which each country is represented by one delegate. As a rule, it attracts the closest attention not only from the press, but also from key players in the global oil market. The conference determines the main directions of OPEC policy, ways and means of their practical implementation, and decides on reports and recommendations submitted by the Board of Governors, as well as on the budget. It entrusts the Council with the preparation of reports and recommendations on any matter of interest to the organization. The conference also forms the Board of Governors (one representative per country, as a rule, these are the ministers of oil, mining or energy). She chooses the president and appoints the general secretary of the organization.

The Secretariat carries out its functions under the direction of the Board of Governors. The Secretary General is the highest official of the Organization, the authorized representative of OPEC and the head of the Secretariat. He organizes and directs the work of the Organization. The structure of the OPEC secretariat includes three departments.

The OPEC Economic Commission is dedicated to promoting stability in international oil markets at fair price levels so that oil can maintain its importance as a primary global energy source in line with OPEC's objectives, closely monitors changes in energy markets and informs the Conference of these changes. .

History of development and activity of OPEC

The task of OPEC since the 1960s has been to present a common position of oil producing countries in order to limit the influence of the largest oil companies on the market. However, in reality, OPEC in the period from 1960 to 1973. could not change the balance of power in the oil market. The war between Egypt and Syria, on the one hand, and Israel, on the other, which suddenly began in October 1973, made significant adjustments to the balance of power. With the support of the United States, Israel managed to quickly regain the lost territories and in November sign ceasefire agreements with Syria and Egypt.

October 17, 1973 OPEC opposed the US policy by imposing an embargo on oil supplies to that country and increasing selling prices by 70% for the United States' Western European allies. Overnight, a barrel of oil rose from $3 to $5.11. (In January 1974, OPEC raised the price per barrel to $11.65). The embargo was introduced at a time when about 85% of American citizens were already accustomed to getting to work in their own car. Although President Nixon imposed strict restrictions on the use of energy resources, the situation could not be saved, and a period of economic recession began for Western countries. At the peak of the crisis, the price of a gallon of gasoline in the US rose from 30 cents to $1.2.

Wall Street's reaction was immediate. Naturally, on the wave of super profits, the shares of oil companies went up, but all other shares lost an average of 15% between October 17 and the end of November 1973. The Dow Jones index during this time fell from 962 to 822 points. In March 1974, the embargo against the United States was lifted, but the effect that it produced could not be smoothed out. In two years, from January 11, 1973 to December 6, 1974, the Dow fell by almost 45% - from 1051 to 577 points.

Revenues from the sale of oil for the main Arab oil-producing countries in 1973-1978. grew at an unprecedented rate. For example, the revenues of Saudi Arabia grew from $4.35 billion to $36 billion, Kuwait - from $1.7 billion to $9.2 billion, Iraq - from $1.8 billion to $23.6 billion.

In the wake of high oil revenues, in 1976 OPEC created the OPEC Fund for International Development, a multilateral development finance institution. Its headquarters is also located in Vienna. The Fund is designed to promote cooperation between OPEC member states and other developing countries. International institutions whose activities benefit developing countries and all non-OPEC developing countries can benefit from the Fund. The OPEC Fund provides loans (on concessional terms) of three types: for projects, programs and support of the balance of payments. Resources consist of voluntary contributions from member countries and profits generated from the fund's investment and lending operations.

However, by the end of the 1970s, oil consumption began to decline for a variety of reasons. First, non-OPEC countries have increased their activity in the oil market. Secondly, a general decline in the economies of Western countries began to manifest itself. Thirdly, efforts to reduce energy consumption have borne some fruit. In addition, the United States, concerned about possible shocks in oil-producing countries, the high activity of the USSR in the region, especially after the introduction Soviet troops to Afghanistan, were ready to use military force in the event of a recurrence of the situation with oil supplies. Ultimately, oil prices began to decline.

Despite all the measures taken, in 1978 a second oil crisis erupted. The main reasons were the revolution in Iran and the political resonance caused by the agreements at Camp David between Israel and Egypt. By 1981, the price of oil had reached $40 per barrel.

The weakness of OPEC was fully manifested in the early 1980s, when, as a result of the full development of new oil fields outside the OPEC countries, the widespread introduction of energy-saving technologies and economic stagnation, the demand for imported oil in industrialized countries fell sharply, and prices fell by almost half. After that, the oil market experienced calm and a gradual decline in oil prices for 5 years. However, when in December 1985 OPEC sharply increased oil production - up to 18 million barrels per day, a real price war began, provoked by Saudi Arabia. Its result was that within a few months, crude oil more than doubled in price - from 27 to 12 dollars per barrel.

The fourth oil crisis erupted in 1990. On August 2, Iraq attacked Kuwait, prices jumped from $19 a barrel in July to $36 in October. However, then oil fell to its previous level even before the start of Operation Desert Storm, which ended in the military defeat of Iraq and the economic blockade of the country. Despite persistent overproduction of oil in most OPEC countries and increased competition from other oil-producing countries, oil prices remained relatively stable throughout the 1990s compared to the fluctuations they experienced in the 1980s.

However, at the end of 1997, oil prices began to fall, and in 1998 the world oil market was gripped by an unprecedented crisis. Analysts and experts cite many various reasons this sharp drop in oil prices. Many tend to place all the blame on the decision of OPEC, adopted at the end of November 1997 in Jakarta (Indonesia), to raise the ceiling on oil production, as a result of which additional volumes of oil were allegedly thrown onto the markets and prices fell. The efforts made by OPEC members and non-members in 1998 undoubtedly played a major role in preventing a further collapse of the world oil market. Without the measures taken, the price of oil, according to some experts, could fall to 6-7 dollars per barrel.

Development problems of OPEC countries

One of the main shortcomings of OPEC is that it brings together countries whose interests are often opposed. Saudi Arabia and other countries of the Arabian Peninsula are sparsely populated, but have huge oil reserves, large investments from abroad, and maintain very close relations with the West. oil companies.

Other OPEC countries, such as Nigeria, are characterized by high population and poverty, costly economic development programs and huge debts.

The second seemingly simple problem is the banal "what to do with money." After all, it is not always easy to properly dispose of the downpour of petrodollars that has poured into the country. The monarchs and rulers of the countries that were overwhelmed with wealth sought to use it "for the glory of their own people" and therefore started various "constructions of the century" and other similar projects that cannot be called a reasonable investment of capital. Only later, when the euphoria from the first happiness passed, when the ardor cooled a little due to the fall in oil prices and the decline in government revenues, did the state budget funds begin to be spent more reasonably and competently.

The third, main problem is compensation for the technological backwardness of the OPEC countries from the leading countries of the world. Indeed, by the time the organization was created, some of the countries included in its composition had not yet got rid of the remnants of the feudal system! The solution to this problem could be accelerated industrialization and urbanization. The introduction of new technologies into production and, accordingly, the life of people did not pass without a trace for the people. The main stages of industrialization were the nationalization of some foreign companies, such as ARAMCO in Saudi Arabia, and the active attraction of private capital into the industry. This was carried out through comprehensive state assistance to the private sector of the economy. For example, in the same Arabia, 6 special banks and funds were created, which provided assistance to entrepreneurs under state guarantees.

The fourth problem is the insufficient qualification of national personnel. The fact is that workers in the state turned out to be unprepared for the introduction of new technologies and were unable to maintain modern machine tools and equipment that was supplied to oil producing and processing enterprises, as well as other plants and enterprises. The solution to this problem was the involvement of foreign specialists. It wasn't as easy as it seems. Because soon it gave rise to a lot of contradictions, which all intensified with the development of society.

Thus, all eleven countries are deeply dependent on the income of their oil industry. Perhaps the only one of the OPEC countries that represents an exception is Indonesia, which receives significant income from tourism, timber, gas sales and other raw materials. For the rest of the OPEC countries, the level of dependence on oil exports ranges from the lowest - 48% in the case of the United Arab Emirates to 97% in Nigeria.

Today, more than four thousand international intergovernmental organizations operate in the world. Their role in the global economy is difficult to overestimate. One of these largest organizations, the name of which is now on everyone's lips, is the Organization of the Petroleum Exporting Countries (Eng. The Organization of the Petroleum Exporting Countries; abbreviated as OPEC).

The organization, also called a cartel, was created by oil-producing countries to stabilize oil prices. Its history dates back to September 10-14, 1960, from the Baghdad Conference, when OPEC was created to coordinate the oil policy of member states and, most importantly, in particular to ensure the stability of world oil prices.

History of OPEC

At first, the countries forming OPEC were tasked with increasing concession payments, but OPEC's activities went far beyond this task and had a great influence on the struggle of developing countries against the neo-colonial system of exploiting their resources.

At that time, world oil production was practically controlled by the seven largest multinational companies, the so-called "Seven Sisters". Completely dominating the market, the cartel did not intend to reckon with the opinion of the oil-producing countries, and in August 1960 it reduced the purchase prices for oil from the Near and Middle East to the limit, which for the countries of this region meant multimillion-dollar losses in the shortest possible time. And as a result, five developing oil-producing countries - Iraq, Iran, Kuwait, Saudi Arabia and Venezuela - have taken the initiative. More precisely, the initiator of the birth of the organization was Venezuela - the most developed of the oil-producing countries, which for a long time was subjected to the exploitation of oil monopolies. Understanding the need to coordinate efforts against the oil monopolies was also brewing in the Middle East. This is evidenced by several facts, including the Iraqi-Saudi agreement of 1953 on the coordination of oil policy and the meeting of the Arab League in 1959, devoted to oil problems, which was attended by representatives of Iran and Venezuela.

In the future, the number of countries included in OPEC increased. They were joined by Qatar (1961), Indonesia (1962), Libya (1962), United Arab Emirates (1967), Algeria (1969), Nigeria (1971), Ecuador (1973) and Gabon (1975). However, over time, the composition of OPEC has changed several times. In the 90s Gabon left the organization and Ecuador suspended its membership. In 2007, Angola joined the cartel, Ecuador returned again, and since January 2009, Indonesia suspended its membership, as it became an oil importing country. In 2008, Russia declared its readiness to become a permanent observer in the Organization.

Today, any other country that exports significant amounts of crude oil and has similar interests in this area can also become a full member of the organization, provided that its candidacy is approved by a majority of votes (3/4), including the votes of all founding members .

In 1962, in November, the Organization of the Petroleum Exporting Countries was registered with the UN Secretariat as a full-fledged intergovernmental organization. And just five years after its founding, it has already established official relations with the UN Economic and Social Council, became a member of the UN Conference on Trade and Development.

Thus, today the OPEC countries are the united 12 oil-producing states (Iran, Iraq, Kuwait, Saudi Arabia, Venezuela, Qatar, Libya, the United Arab Emirates, Algeria, Nigeria, Ecuador and Angola). The headquarters was originally located in Geneva (Switzerland), then on September 1, 1965 moved to Vienna (Austria).

The economic success of the OPEC member states was of great ideological significance. It seemed that the developing countries of the "poor South" managed to achieve a turning point in the struggle with the developed countries of the "rich North". Feeling like a representative of the "third world", in 1976 the cartel organizes the OPEC Fund for International Development, a financial institution that provides support to developing countries that are not members of the Organization of Petroleum Exporting Countries.

The success of this combination of enterprises has spurred other Third World countries that export raw materials to try to coordinate their efforts to raise revenues in a similar way. However, these attempts turned out to be of little avail, since the demand for other commodities was not as high as for “black gold”.

Although the second half of the 1970s was the peak of OPEC's economic prosperity, this success was not very sustainable. Almost a decade later, world oil prices fell by almost half, thereby sharply reducing the income of the cartel countries from petrodollars.

Goals and structure of OPEC

The proven oil reserves of OPEC countries currently stand at 1,199.71 billion barrels. OPEC countries control about 2/3 of the world's oil reserves, which is 77% of all explored world reserves of "black gold". They produce about 29 million barrels of oil, or about 44% of world production or half of world oil exports. According to the Secretary General of the organization, this figure will increase to 50% by 2020.

Despite the fact that OPEC produces only 44% of the world's oil production, it has a huge impact on the oil market.

Speaking about the serious figures of the cartel, it is impossible not to mention its goals. One of the main ones is to ensure price stability on the world oil markets. Another important task of the organization is to coordinate and unify the oil policy of the member states, as well as to determine the most effective individual and collective means of protecting their interests. The objectives of the cartel include the protection of the environment in the interests of present and future generations.

In short, the union of oil-producing countries defends their economic interests in a united front. In fact, it was OPEC that launched the interstate regulation of the oil market.

The structure of the cartel consists of the Conference, committees, board of governors, secretariat, secretary general and economic commission of OPEC.

The supreme body of the organization is the Conference of Oil Ministers of the OPEC countries, which is convened at least twice a year, usually at the headquarters in Vienna. It determines the key directions of the cartel's policy, ways and means of their practical implementation, and makes decisions on reports and recommendations, including on the budget. The conference itself forms the Board of Governors (one representative from the country, as a rule, these are the ministers of oil, mining or energy), it also appoints the secretary general of the organization, who is the highest official and authorized representative of the organization. Since 2007, it has been Abdullah Salem al-Badri.

Characteristics of the economy of the OPEC countries

Most states of the Organization of the Petroleum Exporting Countries are deeply dependent on the revenues of their oil industry.

Saudi Arabia has the largest oil reserves in the world - 25% of the world's reserves of "black gold" - as a result, the basis of its economy is the export of oil. Oil exports bring to the state treasury 90% of the state's export revenues, 75% of budget revenues and 45% of GDP.

50% of Kuwait's GDP is provided by the extraction of "black gold", its share in the country's exports is 90%. The bowels of Iraq are rich in the largest reserves of this raw material. The Iraqi state-owned companies North Oil Company and South Oil Company have a monopoly on the development of local oil fields. Iran occupies an honorable place in the list of the most oil-bearing countries. It has an oil reserve estimated at 18 billion tons and occupies 5.5% of the world oil products trade market. The economy of this country is also connected with the oil industry.

Another OPEC country is Algeria, whose economy is based on oil and gas. They provide 30% of GDP, 60% of state budget revenues and 95% of export earnings. In terms of oil reserves, Algeria ranks 15th in the world and 11th in terms of its exports.

The economy of Angola is also based on oil production and export - 85% of GDP. It is thanks to the "black gold" that the country's economy is the fastest growing among the states of sub-Saharan Africa.

The Bolivarian Republic of Venezuela replenishes its budget also through oil production, which provides 80% of export earnings, more than 50% of the republican budget revenues and about 30% of GDP. Much of the oil produced in Venezuela is exported to the United States.

Thus, as already mentioned, all twelve OPEC member countries are deeply dependent on the income of their oil industry. Probably the only country in the cartel that benefits from anything other than the oil industry is Indonesia, whose state budget is replenished by tourism, gas sales and other raw materials. For others, the level of dependence on oil exports ranges from the lowest - 48% in the case of the United Arab Emirates, to the highest - 97% - in Nigeria.

Development problems of OPEC member countries

It would seem that the union of the largest oil exporters, which controls 2/3 of the world's reserves of "black gold", should develop exponentially. However, not all so simple. Offhand, there are about four reasons hindering the development of the cartel. One of these reasons is that the Organization brings together countries whose interests are often opposed. Interesting fact: OPEC countries were at war with each other. In 1990, Iraq invaded Kuwait and sparked the Gulf War. After the defeat of Iraq, international trade sanctions were applied to it, which severely limited the country's ability to export oil, which led to even greater volatility in the prices of "black gold" exported from the cartel. The same reason can be attributed to the fact that, for example, Saudi Arabia and other countries of the Arabian Peninsula are among the sparsely populated, but they have the largest oil reserves, large investments from abroad and maintain very close relations with Western oil companies. And other countries of the Organization, such as Nigeria, are characterized by high population and extreme poverty, and they have to carry out costly economic development programs, and therefore have huge external debt. These countries are forced to extract and sell as much oil as possible, especially after the price of crude oil has declined. In addition, as a result political events in the 1980s, Iraq and Iran maximized oil production to pay for military spending.

Today, the unstable political environment in at least 7 of the 12 member countries of the cartel is a serious problem for OPEC. Civil War in Libya significantly disrupted the well-established course of work in the country's oil and gas fields. The events of the Arab Spring affected the normal work in many countries of the Middle East region. According to the UN, April 2013 broke records for the number of people killed and injured in Iraq over the past 5 years. After the death of Hugo Chavez, the situation in Venezuela cannot be called stable and calm either.

Compensation for the technological backwardness of OPEC members from the leading countries of the world can be called the main one in the list of problems. No matter how strange it may sound, but by the time the cartel was formed, its members had not yet got rid of the remnants of the feudal system. It was possible to get rid of this only through accelerated industrialization and urbanization, and, accordingly, the introduction of new technologies into production and people's lives did not go unnoticed. Here you can immediately point out another, third, problem - the lack of qualifications among national personnel. All this is interconnected - backward in development countries could not boast of highly qualified specialists, workers in the states turned out to be unprepared for modern technologies and equipment. Since local personnel could not service the equipment that was installed at oil producing and processing enterprises, the management urgently had to involve foreign specialists in the work, which, in turn, created a number of new difficulties.

And the fourth barrier, it would seem, does not deserve special attention. However, this banal reason significantly slowed down the movement. “Where to put the money?” - such a question arose before the OPEC countries, when a stream of petrodollars poured into the countries. The leaders of the countries could not reasonably manage the collapsed wealth, so they started various meaningless projects, for example, “constructions of the century”, which cannot be called a reasonable investment of capital. It took some time for the euphoria to subside as oil prices began to fall and government revenue fell. I had to spend money more wisely and competently.

As a result of the influence of these factors, OPEC has lost its role as the main regulator of world oil prices and has become only one (albeit very influential) of the participants in exchange trading on the world oil market.

Prospects for the development of OPEC

The prospects for the development of the Organization today remain uncertain. Experts and analysts on this issue are divided into two camps. Some believe that the cartel managed to overcome the crisis of the second half of the 1980s and early 1990s. Of course, we are not talking about returning the former economic power, as in the 70s, but on the whole the picture is quite favorable, there are necessary opportunities for development.

The latter will tend to believe that the cartel countries are unlikely to be able to comply with the established oil production quotas and a clear common policy for a long time.

Among the countries of the Organization, even the richest in oil, there is not a single one that has managed to become sufficiently developed and modern. Three Arab countries - Saudi Arabia, the United Arab Emirates and Kuwait - can be called rich, but not developed. As an indicator of their relative underdevelopment and backwardness, one can cite the fact that monarchist regimes of the feudal type are still preserved in all countries. The standard of living in Libya, Venezuela and Iran is approximately similar to the Russian level. All this can be called the natural result of unreasonableness: abundant oil reserves provoke a struggle, but not for the development of production, but for political control over exploitation. natural resources. But on the other hand, we can name countries where resources are exploited quite efficiently. Examples are Kuwait and the United Arab Emirates, where current revenues from raw materials are not only wasted, but are also set aside in a special reserve fund for future expenses, and also spent on boosting other sectors of the economy (for example, the tourism business).

Several factors of uncertainty about the prospects of the Organization of the Petroleum Exporting Countries, such as, for example, the uncertainty of the development of world energy, can significantly weaken the cartel, so no one undertakes to draw unambiguous conclusions.

Oil reserves in the countries of the world (in billion barrels, as of 2012)

Details OrganizationsOPEC(transliteration of the English abbreviation OPEC- The Organization of Petroleum Exporting Countries, literally translated as the Organization of Petroleum Exporting Countries) is an international intergovernmental organization of oil-producing countries created to stabilize oil prices .

The organization was formed during an industry conference in Baghdad on September 10-14, 1960, at the initiative of five developing oil-producing countries: Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. In the future, several other countries joined them.

| Organization of Petroleum Exporting Countries | ©site | |

|---|---|---|

| Foundation date | September 10 - 14, 1960 | |

| Date of commencement of activity | 1961 | |

| Headquarters location | Vienna, Austria | |

| The president | Rostam Gasemi | |

| General Secretary | Abdullah Salem al-Badri | |

| Official site | opec.org | |

OPEC's goal is the coordination of activities and the development of a common policy regarding oil production among the member countries of the organization, maintaining the stability of world oil prices, ensuring uninterrupted supplies of raw materials to consumers and obtaining a return on investment in the oil industry.

For a more efficient calculation of the cost of oil produced in the member countries of the organization, the so-called " OPEC oil basket"- a certain set of grades of oil produced in these countries. The price of this basket is calculated as the arithmetic average of the cost of its constituent grades.

Composition of OPEC

| Country | Year of entry | ©site |

|---|---|---|

| Iran | 1960 | |

| Iraq | 1960 | |

| Kuwait | 1960 | |

| Saudi Arabia | 1960 | |

| Venezuela | 1960 | |

| Qatar | 1961 | |

| Libya | 1962 | |

| United Arab Emirates | 1967 | |

| Algeria | 1969 | |

| Nigeria | 1971 | |

| Ecuador* | 1973 | |

| Gabon** | 1975 | |

| Angola | 2007 | |

| Equatorial Guinea | 2017 | |

| Congo | 2018 | |

*Ecuador was not a member of the organization from December 1992 to October 2007.

**Gabon suspended membership in the organization from January 1995 to July 2016.

In addition, Indonesia was a member of OPEC - from 1962 to 2009, and from January 2016 to November 30, 2016.

Background and history of creation

In the 1960s of the last century, some states, in particular those that later joined OPEC, gained their independence. At the time, global oil production was ruled by a seven-company cartel known as " seven sisters":

- Exxon

- Royal Dutch Shell

- Texaco

- Chevron

- Mobile

- gulf oil

- British Petroleum

At some point, this cartel decided to unilaterally lower the purchase price of oil, resulting in a reduction in taxes and rents that they paid to countries for the right to develop oil fields on their territory. This event served as a catalyst for the establishment of OPEC, the purpose of which was to obtain new independent states control over their resources and their exploitation, taking into account national interests, as well as preventing a further fall in oil prices.

The organization began its activity in January 1961, having created the Secretariat of the organization in Geneva. In September 1965 he was transferred to Vienna. In 1962, the Organization of the Petroleum Exporting Countries was registered with the UN Secretariat as a full-fledged intergovernmental organization.

In 1968, the Declaration "On the Petroleum Policy of the OPEC Member Countries" was adopted, the content of which emphasized the inalienable right of the member countries of the organization to exercise permanent sovereignty over their natural resources in the interests of their national development.

During the 1970s, OPEC's influence on the world market not only grew, but it became the most important organization on whose policies crude oil prices began to depend. This state of affairs was facilitated, firstly, by the governments of states taking oil production in their territories under tight control, and secondly, by the embargo on the supply of oil Arab countries in 1973, and thirdly, the start of the Iranian revolution in 1979.

| Country | Field | ©site | Production start year | Starting year of export |

|---|---|---|---|---|

| Algeria | Edjelleh | 1956 | 1958 | |

| Angola | Benfica(Cuanza Basin) | 1955 | ||

| Venezuela | Zumaque I (Mene Grande field) | 1914 | ||

| Iraq | Baba (Kirkuk field) | 1927 | ||

| Iran | Masjid-i-Solaiman (Khozestan Province)* | 1908 | ||

| Qatar | Dukhan | 1935 | 1939 - 1940 | |

| Kuwait | Al Burqan | 1938 | 1946 | |

| Libya | Amal and Zelten (modern Nasser) | 1959 | 1961 | |

| Nigeria | Oloibiri (Bayelsa State) | 1956 | ||

| UAE | Bab-2 and Umm Shaif | 1958 | ||

| Saudi Arabia | Dammam | 1938 | ||

| Ecuador | Ancon 1 (Santa Elena Peninsula) | 1921 | ||

*First oil well in the Middle East.

The first summit meeting of the heads of state and government of the Organization of the Petroleum Exporting Countries took place in Algiers in 1975. (By the way, in the same year, on December 21, the headquarters of the organization was captured by a group of six armed terrorists led by Carlos the Jackal).

In 1986, oil prices hit an all-time low of about $10 a barrel. The share of OPEC in world oil production has decreased, sales revenue has fallen by a third. This caused serious economic difficulties for almost all members of the organization.

Thanks to the coordinated actions of the OPEC member states, in particular, the establishment of oil production quotas and the pricing mechanism, oil prices were able to stabilize at a level approximately equal to half the level of prices in the early 1980s (it was in the early 80s that oil prices reached their record highs). ). After that, the role of the Organization of the Petroleum Exporting Countries in the context of the newly growing world production began to recover.

| OPEC in numbers (data for 2014) | ©site | |

|---|---|---|

| 1206.2 billion barrels | Total proven oil reserves of OPEC member countries | |

| 2/3 | Share of all world oil reserves | |

| 40% | world oil production | |

| 50% | World oil export | |